Most of us have browsed over a property listing website and figured out that an apartment with a sea view costs more than a similar apartment without a view. But the question is, how much more?

Specifically, if the price of an apartment is determined by a set of factors (like location, size, view, and quality), what is the amount attributable to the view?

If the question is not clear, think about the following situation. Imagine visiting a dealership selling new cars and being given the option to choose between two types of seats: fabric or leather, with all else being equal. You can easily come up with a number that tells you how much more it costs to have leather seats: just subtract the price of the car with the fabric option from the price of the car with the leather option.

The result is the premium paid to have leather seats instead of fabric. In our case, we are looking for the premium paid for having a sea view.

A key difference is that we are looking for the market premium — that is, the premium that emerges through interactions between market participants reselling their homes, and not the premium set arbitrarily by a property developer (like the case of a new cars dealership).

Sounds simple? Answering this question for the case of apartments is difficult as most are different in subtle ways, and it's hard to find a dataset with sales transactions for which all factors contributing to the price (like location, design, view, and age) are equal, except for the view. We don’t want to compare apples to oranges.

We cannot simply take any random apartment with a sea view and any other apartment without a view and calculate the difference — we need to ensure all other factors are equal so they cancel out, isolating the view component. We could try correcting for variations in the other factors, but that is hard and error-prone.

I found an apartment complex (Shoreline Apartments — Dubai) that was built in such a way that allows us to isolate the view component and calculate the premium attributable to the view.

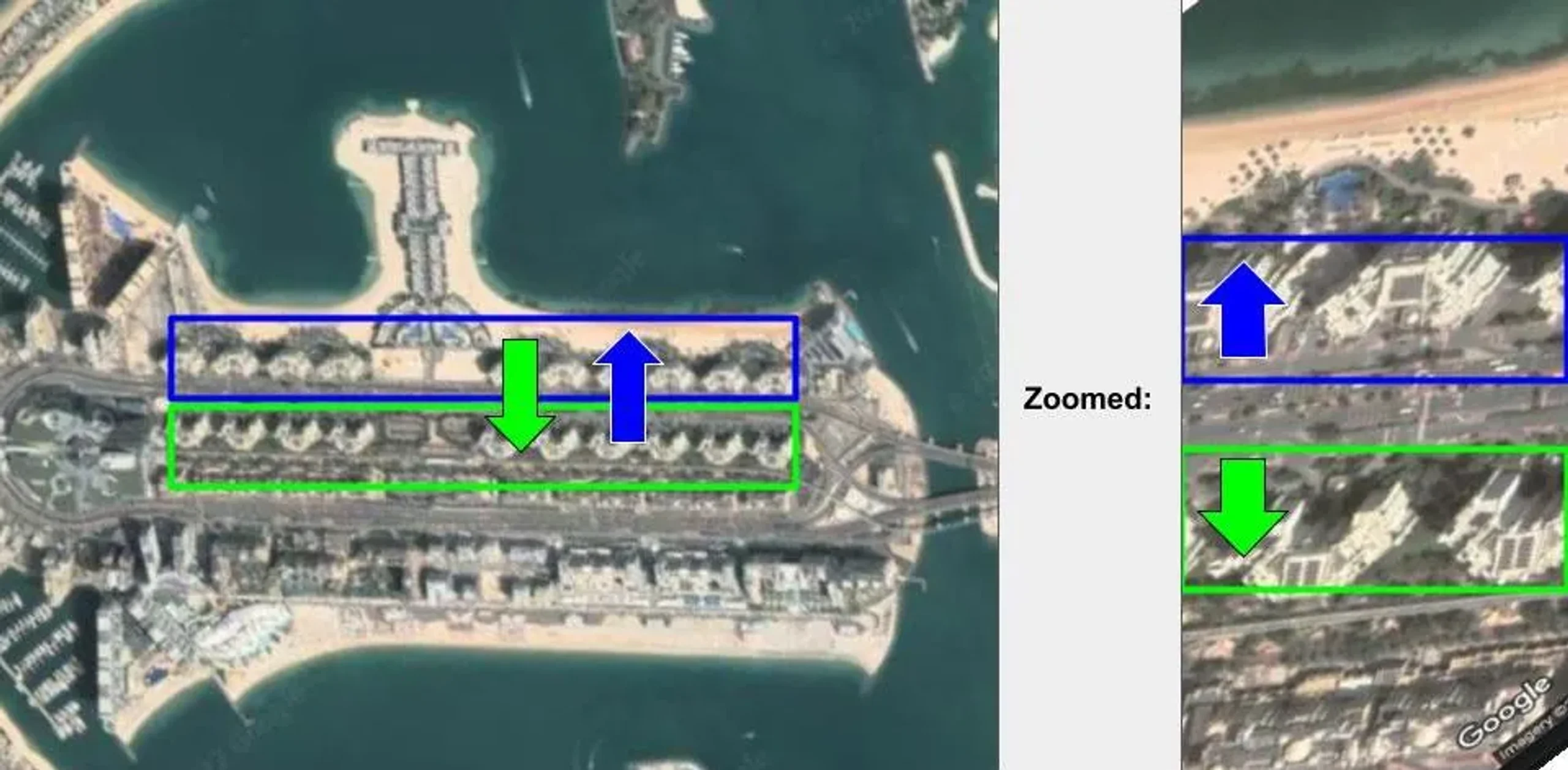

We will focus on a specific apartment layout within the complex, a 1,998 Sq.ft. two-bedroom apartment. This complex has 200 of these with a sea view and 200 with the same characteristics but with a park view. Since the only thing that changes is the view, we can compare these two as apples to apples and find the view-premium.

Sea-view properties' location and view are marked in blue. The park view is marked in green. The arrows point to the view each apartment has. Google Maps.

Looking out the window from the sea-view apartment.

Looking out the window from the park-view apartment.

The layout. Check out more details here.

As a bonus, the sales transactions dataset on this apartment complex spans +10 years, allowing us to answer another interesting question: is the premium constant over time?

You might ask, why should I care about all this? My feeling is these questions are most relevant to real estate developers trying to come up with pricing schemes for new developments by the water and want to figure out what premium to charge for a sea view apartment v.s. one with no water view, to ensure they don’t leave money on the table.

It can serve as a guide for everyone else who is looking to buy or sell an apartment, and it is a fun fact to learn. We find that humans love having a sea view, but what is the premium they are willing to pay to fulfill that desire?

The Analysis

I will give you the results below and spare you the work behind cleaning the data and calculating the premium, but those of you who are curious about it can access it via the link below.

The Results

What is the market premium of having a sea view?

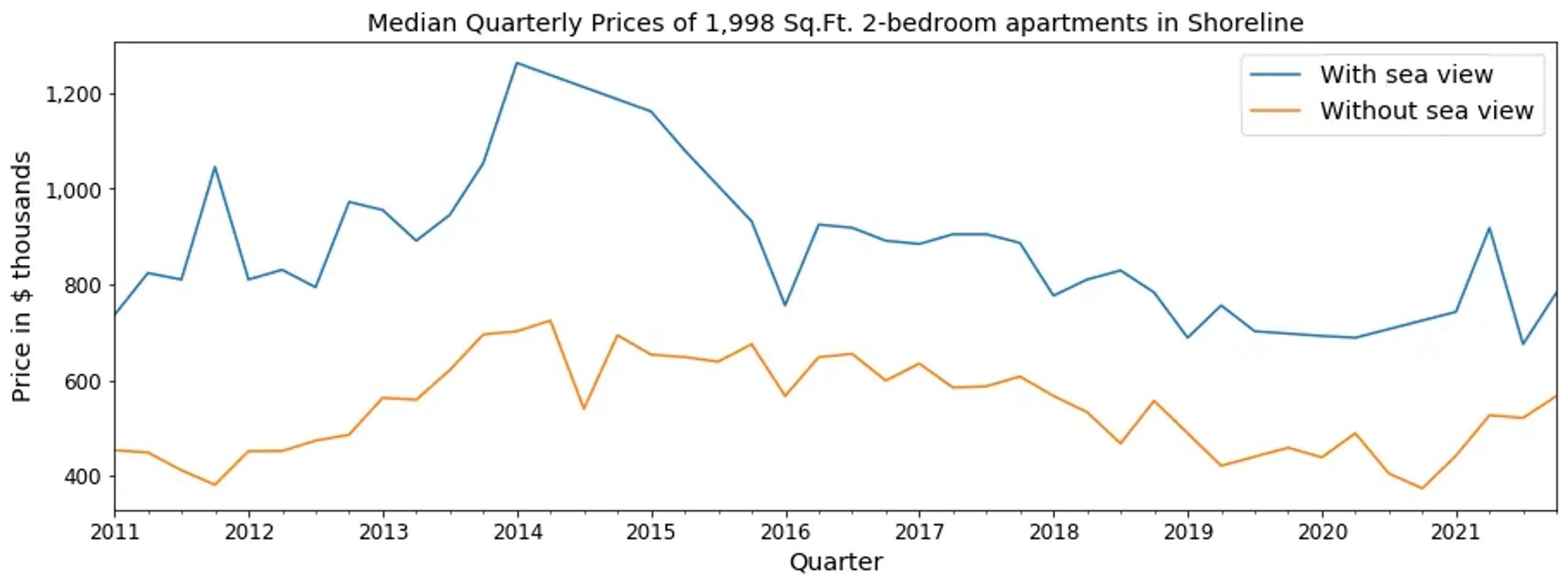

Let’s get answers. To give you a sense of magnitude, I’ll show you a graph with apartment prices over time, split by those with a view and those without. We are considering 1,998 Sq.ft 2-bedroom apartments. Between 2011 and 2022, the average total price of one with a sea view was $865,205 and one with a park view $545,775.

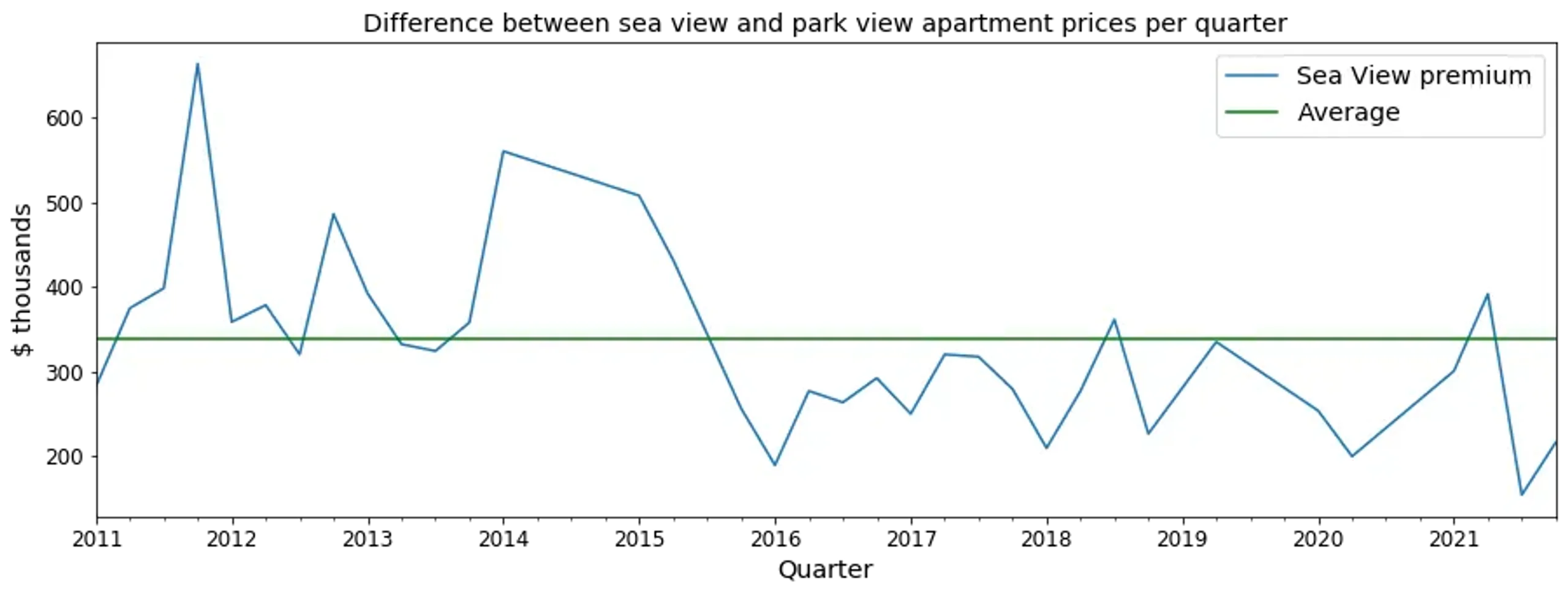

Subtracting one from the other we can see that the sea-view “add-on” costs on average $319,430. Remember that these apartments are otherwise the same — only the view changes. So in other words the average sea-view market premium is $319,430. The graph below shows the premium over time (sea view apartment minus park view apartment). It’s interesting to see how much we care about the view.

We can see that in recent years the premium has remained well below the average.

Is the premium constant over time?

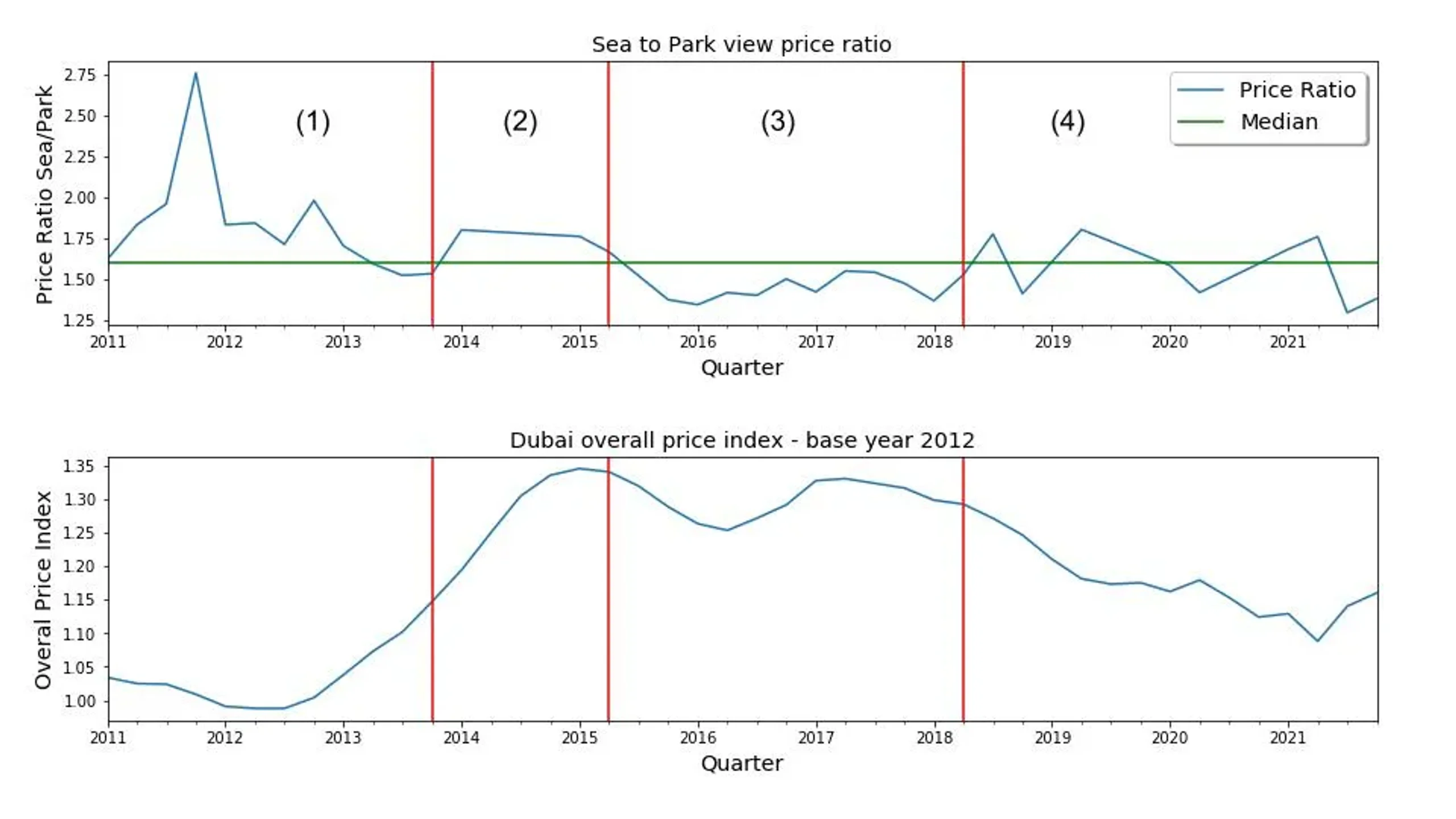

As we saw from the graph above the answer is no. Let’s look at the price ratio between the sea and the park to find out how many times more expensive the sea view apartments are than the park, and how that changes with time. I’m also showing Dubai’s apartment price index which aggregates all apartment sales in the city to measure how overall prices are changing with time. Read more about price indexes here.

We can see the sea view option is generally 60% more expensive (green line at 1.6 times), but that’s not constant.

I’ve divided the plot into four sections as I noticed some interesting relations between the price ratio and the overall price index. In region (2), when overall prices are on the rise, the ratio is always above the median. In region (3), when overall prices are moving sideways, the price ratio stays below the median. In region (4), when overall prices are in constant decline the price ratio oscillates around the median.

It seems that during periods of price appreciation, sea view apartments appreciate at a faster rate; in periods of relative stability, the ratio is compressed as prices reach an equilibrium; and in periods of price declines, the ratio oscillates. Region (1) is hard to read as the index’s base year is in the middle of it and we don’t have data before 2011, so I’ll leave it to the reader to form a hypothesis about what is going on here.

Summing up…

Here’s a summary of some stats to take away from all of this.

- The average sea view premium is $319,430

- Since 2016, the premium has remained under the historical average

- Sea view apartments appreciate faster than the rest when overall prices are on the rise

- A sea view apartment is generally 60% more expensive than the same apartment without a view

- The add-on cost of a sea view is around $160/Sq.Ft (or $1,720/Sq.M)

Future Work

I would have liked to extend the study to more apartment types but Dubai’s transaction records do not disclose the apartment numbers as opposed to countries like the US. This makes it hard to figure out which transaction corresponds to which layout — you can see the amount of work that was required by clicking on the link in the Analysis section. I know I can extend this to at least cover the 1-bedroom apartments which I will do in the future.

Further Reading

If you are curious to learn more about the premium of views, click here to read a study that measures the economic impact of views on office rents in Manhattan, New York City.