The past few years have been a vicious, parabolic trend for Dubai, much to the delight of some and the worry of others. As an agent, I need to believe in my product. Recently, more critical voices about Dubai and its real estate market have surfaced. So, I decided to do a reality check. And what better way is there to lay out your thoughts in an organized way than in good, old writing?

Do I believe that Dubai is overhyped? That's the question I will try to answer for myself and you. And I will start at the point where my own doubts began.

This article is only for you if you have decided deep inside that you want to buy a property in Dubai but are unsure if now is the right time.

If you are only starting your research or randomly ran into this article, consider saving your time and skipping it (especially as it's pretty long and dry).

A few months ago (probably more than six but less than nine), one of my colleagues at the company I was working for said: "I would never buy anything in the Off-Plan!". That statement startled me since we both were doing Off-Plan exclusively, and he was even selling outrageously well. I didn't think much of it at the time, but the seed was planted, and every time I ran into some nonsense happening in the market, doubts would arise: How much worse can this get before it comes down on us?

Some time passed, and a client approached me about a townhouse by Damac in a community that had been released slightly over two years ago (at the time of talking with him). He was waiting for prices to come down and was hoping I could help him close in on his budget. He told me the price he was willing to buy for, which I remember was just marginally above the launch price. I checked some portals and looked through some private WhatsApp groups for offers on that project and quickly realized that the price, in fact, had almost doubled. When I told him what I had found and that the gap was too big to do anything about it, he agreed and said he would still prefer to wait. The confidence that he was displaying made me believe he knew what he was doing and that the market may be overbought.

Another few months later, I found a comment written by a friend in a Facebook discussion about real estate investing overseas. He runs a large expat community, is vastly successful with many ventures, and is a brilliant, independent thinker unafraid of saying outrageous things against the mob. His comment was as succinct as opinionated: "Dubai is over-overhyped."

My face went blank.

Signal vs Noise

Enough! I finally slammed my fist on the table. How could I be so confused about the product I was selling? It was time to examine all the opinions and reevaluate the real world.

Source of the noise

Whenever I encounter people who own real estate in Dubai, they are supremely content. Maybe that's just my social bubble, but most pushback I see is from people who do not own a property in Dubai yet or who have made an actually poor purchase and now feel the need to loudly warn everybody else of this "scam", doing so on Facebook or other online forums.

Here is a popular thread on Reddit. The author and some commenters seem convinced that properties in Dubai are overpriced and the market has to come down. The author even predicted that the crash (he speaks of at least 30%) would happen by "the end of the third quarter this year [2023]".

We are now pretty close to that date, and prices have at least added 10% (more like 15% in the off-plan market) all over Dubai since then.

Here are a few more excerpts from the discussion:

Propaganda machine Dubai

Dubai has made a splash. For the past few months, you can hear it everywhere. Rappers are filming their videos in Dubai and including them in their lyrics. Podcasts are shot in Dubai, and the city always gets mentioned in some context (overwhelmingly in a positive light, however). TV series and movies are shot here. It's the city of the future, the city of technology, business, opportunity, and luxury.

You can feel that something is brewing. And for what it's worth, Dubai is probably about to explode.

Of course, there has also been a lot of critical pushback on the hype, but whether it's justified or not, you can tell one side strongly overwhelms the other. Suppose you just put on an investor's hat and don't judge morals. In that case, you are left with no choice but to admit that Dubai is successfully portrayed as an outrageously attractive city (and since that's eventually up to the individual to judge, let me tell you that countless people living here, in fact, think so, too. Even those who you wouldn't expect to love the city).

I don't say you should ignore your morals. I know a lot is going wrong in Dubai, but such is the case in most other places of the world. Raising my index finger and determining that everything in Europe is so much better regarding environmental practices or human rights is neither my job nor do I genuinely think it's the case. You can find hypocrisy everywhere, and while Dubai is certainly not free of guilt, I can not say it's better or worse than elsewhere. Therefore, I don't bring my emotions into the game and just look at it economically and financially.

Judging the Quality of Life in Dubai

When it comes down to choosing a place to live for you and your family, or even just to decide where you want to spend your next vacation, quality of life is one of the most deciding factors.

With this naive yet legitimate understanding, my simple question is: How desirable is it to live (or spend your time) in Dubai?

Starting with data, there are two livability indexes I'd like to reference. The first is the yearly "Global Liveability Index 2023" by the Economist Intelligence, which ranks 173 cities (Vienna is number one, Damascus number 173, and Dubai ranks 76th). This isn't great, but also not too bad. Living here, I can understand why it's not further on the top. There are issues like omnipresent construction sites, suboptimal air quality, the neverending scorching sun, and other issues.

Another livability online index here paints a different picture than the Economists' one. Here, we have 193 cities, led by The Hague, ended by Manila, and Dubai ranked 26th.

I deduce from these rankings that the average life quality objectively is just that: average (which may sound worse than it is because "average" is used in a statistical context here more than a qualifying). It is apparent that with enough money and hospitality, Dubai can easily provide an elite lifestyle. Yet, we should acknowledge that, in fact, even in Dubai, the majority are financially regular people who will inhabit most of the standard real estate. In addition, with enough financial means, you can enjoy an excellent life everywhere, anyway.

It's reasonable to assume that the living standard, in this case, is not strong enough of a reason to solely attract (or, likewise, repel) the majority of people.

That said, I have had various personal encounters with people where I was baffled about how much they like life here.

For instance, I once met up with a client who is a successful interior designer from Las Vegas. She had come to Dubai for a short trip to an architect convention and was planning to expand her business. She told me that she had fallen in love with the city and lifestyle, extended her stay for two more weeks, and swiftly bought two apartments. When I contacted her later to see how life was going back in Las Vegas, she laughed: "Who said I went back?"

I confronted my expat friend who had written the comment on Facebook that Dubai was overhyped. I asked him what exactly he was referring to, and he told me he was just referring to property prices. As a place to live, he likes it a lot (which I will further leave uncommented).

A closing thought on life quality and its future outlook is that it is a relative metric. For one city to offer a better standard of life, others must have a worse standard. From that point of view, cities in Europe and the USA, which still lead the indexes at the time, are deteriorating rapidly. Dubai, on the other hand, is steadily improving and creeping its way up.

Supply and Demand

Nothing else determines the price as much as Supply and Demand. This is the foundation of all economic matters that we had to learn in school or college. So how does it go?

This is more challenging to determine than you might think. We lack the appropriate and fresh data since demand is defined as more than simply closed deals: It's the consumers' desire, willingness, and ability to pay a certain price for the product.

You can bet a massive number of people are quietly anticipating a more significant pullback to get into the market at a lower price. That group with their individual price targets is not recorded anywhere. Ultimately, we all want the market to go up, but some hope for a better entry price. They try to time the entry and a theoretical exit perfectly (practice shows that's almost impossible to do, and hope is quite a lousy investment strategy).

Since there is no dataset to reflect the true demand, I want to infer it from a hybrid perspective. We will look at the data for population growth and the number of tourists who come to Dubai annually. Then, I will walk you through the daily chatter I encounter as a realtor with clients and colleagues.

First, here are some marks of the population since 2015 (you can check those numbers yourself on the Dubai Statistics Center by the government):

- December 31st, 2015: 2,447,351

- December 31st, 2016: 2,699,355 (+252,004 / +10,29%)

- December 31st, 2017: 2,977,028 (+277,673 / +10,28%)

- December 31st, 2018: 3,192,848 (+215,820 / +7,24%)

- December 31st, 2019: 3,356,267 (+163,419 / +5,11%)

- December 31st, 2020: 3,411,341 (+55,074 / +1,64%)

- December 31st, 2021: 3,478,496 (+67,155 / +1,96%)

- December 31st, 2022: 3,550,186 (+71,690 / +2,06%)

- September 10th, 2023 (date of writing this article, more than 3 months left in the year): 3,622,359 (+72,173 / +2,03%)

The trend should be absolutely evident. Not only does Dubai grow, but also the rate at which it grows.

From here, let's also look at the number of tourists who visit Dubai every year and also need accommodation (and because Dubai varies a lot during low- and high-season, we will check the quarters).

The information is once again accessible at the Dubai Statistics Center.

- Q1 2018: 4,650,000

- Q2 2018: 8,100,000

- Q3 2018: 11,580,000

- Q4 2018: 15,920,000

- Total 2018: 40,250,000

- Q1 2019: 4,750,000

- Q2 2019: 8,360,000

- Q3 2019: 12,080,000

- Q4 2019: 16,730,000

- Total 2019: 41,920,000

- Q1 2020: data unavailable

- Q2 2020: data unavailable

- Q3 2020: data unavailable

- Q4 2020: data unavailable

- Total 2020: 5,510,000

- Q1 2021: 1,270,000

- Q2 2021: 2,500,000

- Q3 2021: 3,850,000

- Q4 2021: 7,280,000

- Total 2021: 14,900,000

- Q1 2022: 3,970,000

- Q2 2022: 7,120,000

- Q3 2022: 10,120,000

- Q4 2022: 14,360,000

- Total 2022: 35,570,000

- Q1 2023: 4,670,000

- Q2 2023: 8,550,000

- Q3 2023: TBD

- Q4 2023 TBD

2020 and 2021 are hard to evaluate due to the pandemic, and 2023 has yet to end (although it seems highly similar to 2019). So let's take the weaker of the strongest quarters (Q4 2022 with 14,360,000 tourists) as a reference since the maximum needs to be accommodated (and in terms of profitable investing, high-season is capable of turning the whole year profitable, as an Airbnb host has disclosed in an interview).

According to Statista, the average stay of Americans in Dubai ranged from 5.9 to 7.5 days. We will take the shorter duration and assume that, on average, 2.5 people share one unit to be somewhat conservative. That creates a demand for 14,360,000 / 2.5 * 5.9 / 90 (days in one quarter) = 376,551 accommodations in Q4 2022.

This is a naive calculation to give us a basic idea of what we are dealing with on paper. You can adjust the numbers if you believe them to be different.

With these numbers, we can gauge the demand and understand the trajectory. Again, the numbers for tourism are difficult to interpret due to COVID. Suppose the industry will return to pre-pandemic numbers (there is really no reason why not). In that case, you can add at least 5 million tourists annually to the picture.

From here, let's look at the supply side of things.

According to the Dubai Statistics Center, there were 807,359 total housing units at the end of 2022, of which 804 are hotel buildings (but only 610 operating). Those hotels offered 120,602 rooms in total (leaving Dubai with 686,757 residential units). Also, that means 14.9% of all properties in Dubai are hotel units.

That's 197.7 rooms per hotel on average. For example, the Burj Al Arab has 205 rooms, and the JW Marriott Marquis Dubai has the most rooms in Dubai, counting 1,608 (source: Wikipedia).

Additionally, there were 15,984 Airbnbs listed in June 2022. Starting with the demand for tourism housing, we determined a need for 376,551 units at the peak. But Dubai only has 120,602 + 15,984 = 136,586 units for short-term to offer.

It's easy to assume that there is a massive supply shortage (less than 50% of the demand being met), but I have a reasonable explanation:

The Dubai Statistics Center defined tourists as non-residential individuals who stay at least one day and land in one of Dubai's airports. However, it is unknown where they go from there. Many probably go to Sharjah, Ajman, Ras Al Khaimah, Abu Dhabi, or elsewhere, not staying in Dubai. Many may also visit friends and live at their places. Some tourists will be non-residents who own a vacation property without being registered as residents.

Still, just from looking at the macabre price surges for short-term stays in the high season, it's common sense to assume that demand is covered, but barely so (if the prices go any lower, demand wouldn't be covered). Time has yet to prove it, but it seems that Dubai is only picking back up on tourism.

We know that 686,757 residential properties were needed to accommodate 3,550,186 people at the end of 2022, which means there are 0.19 properties available for every Dubai resident.

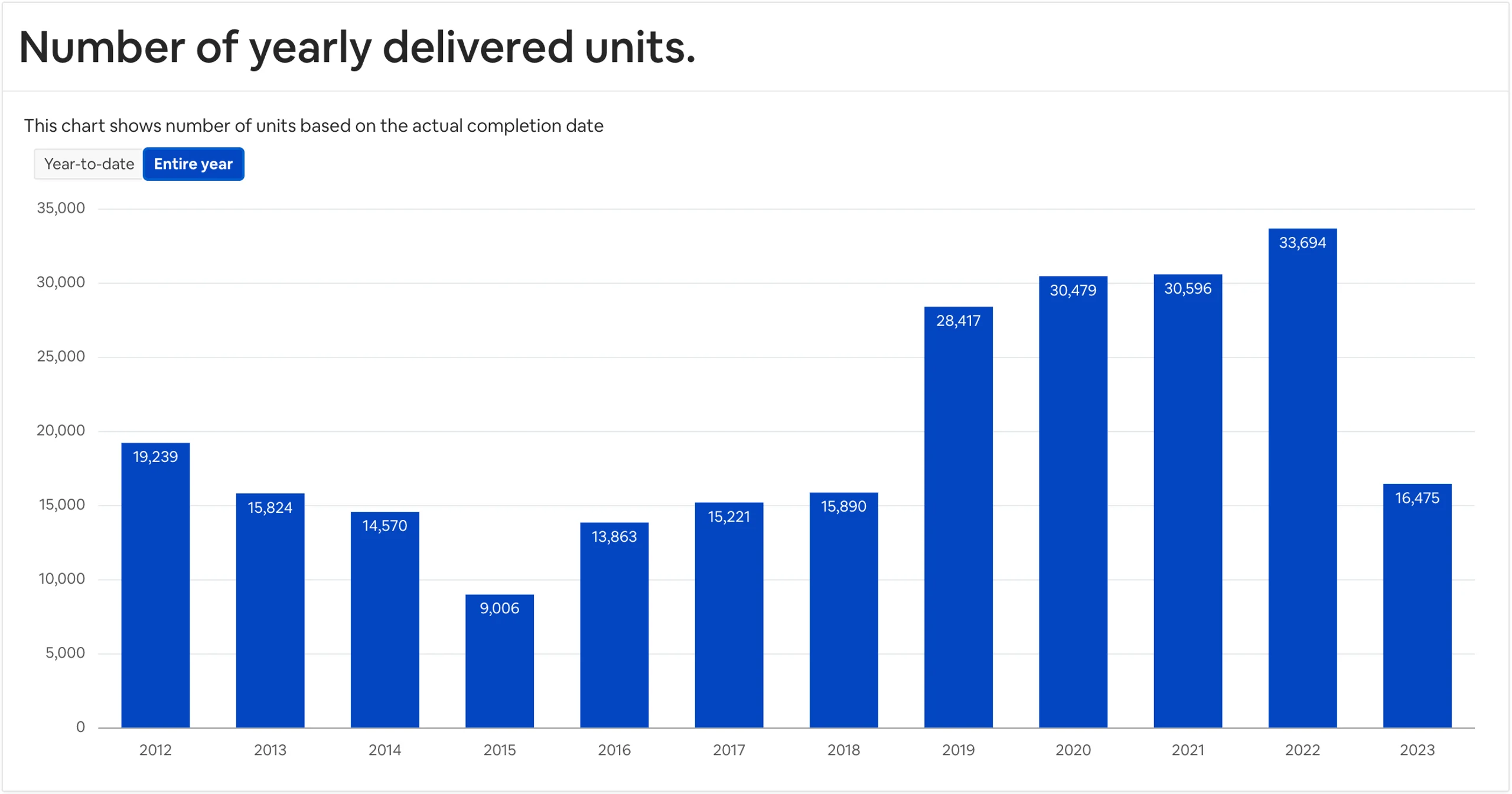

For context, here is how the supply has developed over the past few years, according to DxbInteract. The following is the amount of actually delivered units in a respective year:

- 2016: 7,307 properties delivered (0.03 units / new resident)

- 2017: 8,902 properties delivered (0.03 units / new resident)

- 2018: 9,668 properties delivered (0.045 units / new resident)

- 2019: 20,273 properties delivered (0.124 units / new resident)

- 2020: 19,078 properties delivered (0.346 units / new resident)

- 2021: 21,775 properties delivered (0,324 units / new resident)

- 2022: 19,078 properties delivered (0,266 units / new resident)

- 2023 (state at the time of writing, September 10th, 2023): 16,475 properties delivered (0,228 units / new resident)

As you can see, Dubai has been adding very few homes per new resident before 2020, and it is probably safe to assume that there was a massive supply shortage. Since 2020, it has scaled up to almost one property per two new residents.

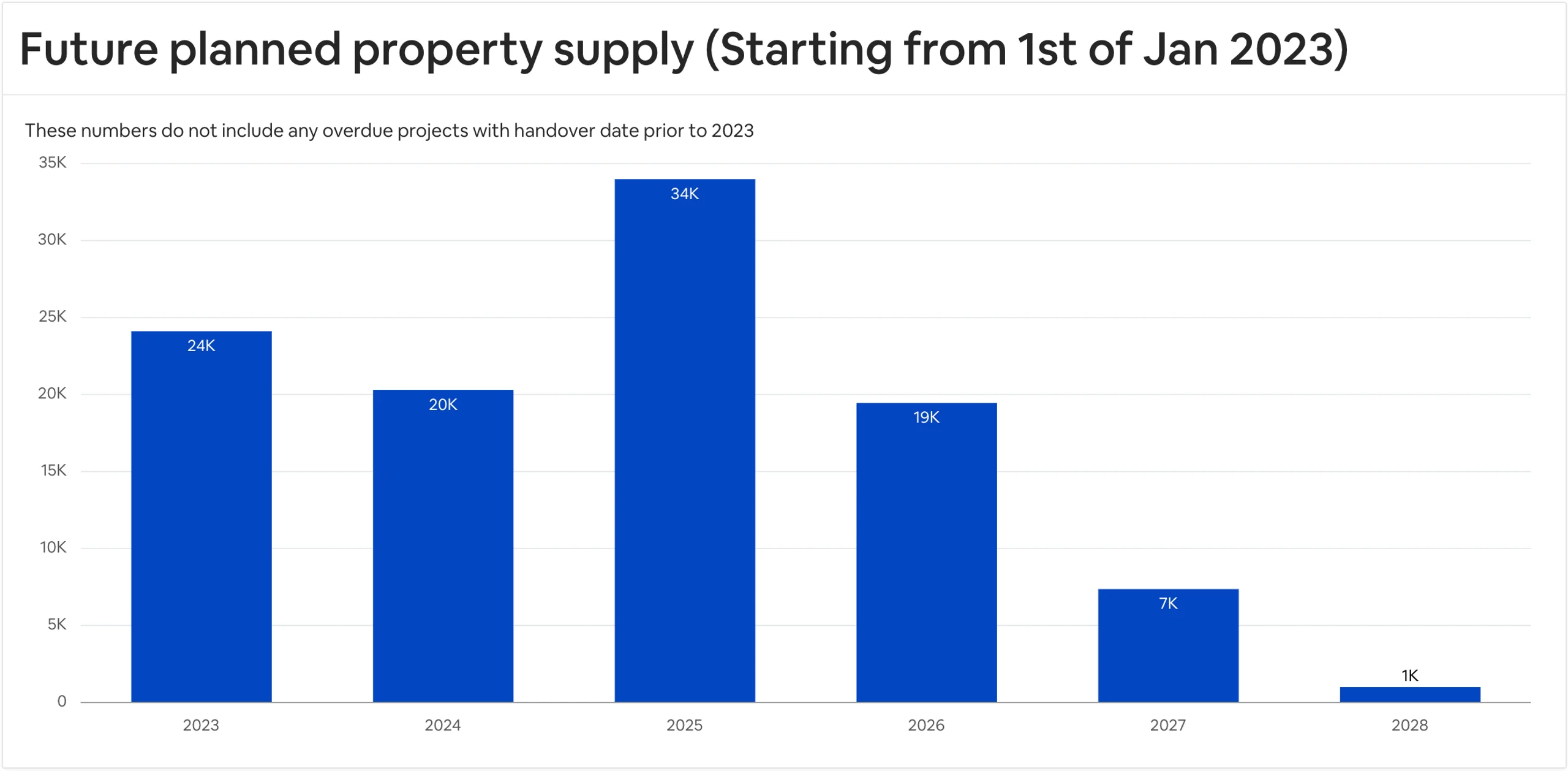

Now let's pull in the last piece of information: The future supply.

Starting with the current year and in the future years, the following amounts of properties are scheduled to be finished (actual completion may differ, more likely delayed than premature):

- 2023: 24,110 properties (16,475 already delivered)

- 2024: 20,300 properties

- 2025: 33,990 properties

- 2026: 19,460 properties

- 2027: 7,369 properties

2023 and 2024 have relatively few homes coming up, only for 2025 to make a considerable jump up and potenti

Note: Most properties (and certainly in good projects) scheduled for 2023, 2024, and even 2025 are largely sold out by now. Also, any project to be completed in 2025 has likely been launched by now (it takes around two years for most projects to finish). So, some new projects will mostly add to 2026 and beyond, but many projects have been launched that are planned to meet even those years.

I will extrapolate the numbers linearly for more accurate, comprehensible, and realistic calculations. Since we have 72,173 new residents for the year on September 10th, 2023, there are 112 days left (112 / 365 = 30.7%). If everything stays the same, Dubai will have grown by 102,664 people to 3,652,850 total (+2.89%) at the end of the year.

The above extrapolation is still conservative and, at the very least, highly likely the minimum growth. Like the influx of tourists, the number of new residents is always the highest in the third and fourth quarter of a year.

So, let's say there is no significant change in the growth rate, at 2.89%, that would propel the population of Dubai to 3,652,850 * 1.0289 = 3,758,417 (+105,567) in 2024. Applying the 14.9% rate of hotel units to the 20,300 upcoming estates, we're left with 17,275 residential properties. That means 105,567 people would have to fill up 17,275 homes (0.16 homes per person). Following up with this calculation for future years (we'll stop at 2026 because the further we look, the less accurate our knowledge of supply becomes, as new projects are more likely to be announced still):

- 2025: +2.89% assumed population growth. 3,867,035 total, +108,618 people. 33,990 properties planned so far, resulting in 0.31 homes for every new resident

- 2026: +2.89% assumed population growth. 3,978,792 total, +111,757 people. 19,460 properties planned so far, resulting in 0.17 homes for every new resident

Comparing these numbers with the number of new homes per new resident before 2024, the supply is running into a shortage again.

Since the population growth rate in 2023 will probably be significantly higher than the linearly extrapolated 2.89%, you should expect the market to go even higher, even faster. Most new project launches name 2026 as the completion year, which leads me to believe that 2025 won't have significantly more properties delivered than currently anticipated, so demand will surge even more in the next two years.

Dubai has a growth plan until 2040. Among other milestones, it's planned to hit 5.8 million residents by 2040. To achieve that, Dubai needs to grow by an average of 2.71%

One thought I have is that most newly finished properties nowadays are filled with amenities and will likely be used by wealthier people. You can interpret this positively or negatively (purely from the investment perspective):

- This may lead to a further price surge because most financially well-established people will not need to share the property to save costs, potentially driving the average of available properties per person even further down. That would definitely result in overall higher prices.

- Understanding that not everybody moving to Dubai is rich, it may cause price fluctuations across market segments. With too many premium properties for too few people who can afford them, prices for new and high-end properties could decline. In contrast, prices for older, lower-end properties might experience a slim price increase.

To be able to put this into context and judge appropriately, we should look at how this played out in the past:

In terms of deviations from the assumed 2.89% growth rate or the actual completion date of projects vs. the assumed, anything that results in a higher demand / lower supply (e.g., more population or less completed projects) will most certainly lead to a significant price surge. In contrast, lower demand / higher supply won't necessarily lead to a noticeable price correction.

The reason I am saying this is because developers and homeowners will take any opportunity to raise prices immediately, while they may be hesitant to sell

Finally, theory and numbers are all good and essential, but I want to provide an insight into the real-life experience of how the supply vs. demand issue feels to an industry professional (or just to someone who lives in Dubai and pays attention to what is going in the real estate market).

Firstly, you get to know a lot of supremely successful realtors. You hear from them how clients are buying ridiculous properties left and right. They are sensing an immense interest from people.

It also shows in the speed at which some projects sell out. For example, Coral Reef by Damac sold out within 6 hours for a total value of $180m. Danube has launched a sequel of three identical towers, Elitz 1, Elitz 2, and Elitz 3, in different locations. They did that because people loved the project so much. Elitz 2 sold out within 15 days (studios were gone after one day). And there are more examples like that. Sometimes, it feels like the first iPhone launch, where people line up hours before the sales office opens to secure their unit, except that the product costs $150k upwards instead of $1k.

Especially in the high season, the city is filled with people. Starting in September, Dubai turns into what feels like an overrun amusement park. Of course, that also creates problems, for example the traffic. But at the same time, you get to see the demand visually, which is an impressive and tangible sight for investors. See below:

Case Studies of Success

Nothing matters if you can't prove people are eventually getting the results they're looking for.

I have been to a few events and talked to people. Mostly, they were happy with how their property investments were developing, if they had any. Occasionally, someone would say, "they would have done it differently if they knew better at the time". Nevertheless, I have not once talked to someone face-to-face who said they had made a straight-up bad deal. At worst, the bottom line was that they could have made a better one. Clients who have bought properties before regularly say they "couldn't be happier" (literally).

A friend of mine is extraordinarily wealthy and probably has over 40 properties scattered around a few countries. Still, his favorite place to buy is Dubai (he also lives here). He did make one unfortunate purchase, but that's clearly an exception in his portfolio. Most of his properties he is holding in anticipation of even higher offers, or rents them out with ungodly ROIs.

Another prime example of success is big investors. I know of internal memos that many real estate brokerage owners keep buying dozens of apartments. They focus on different areas and property types at a time, aggressively scooping up real estate (for example, one of the biggest investors of the palm is currently buying many 1-bedrooms in Downtown). They use their agencies to source the best offers and buy through their own agents.

Crash scenarios

I needed to develop at least one theory of how a crash may play out. Otherwise, how can I take my own conclusion seriously, being so one-sided?

1. Russians pulling out

Should Russians pull their money out of the market (for example, because the war ends and they want to bring it back to their country), it may cause a serious correction (especially if they do it all at once). This scenario does not require further explanation or analysis - we all understand that Russians hold a significant market share.

Personally, I don't think this is a realistic scenario. Neither will the war end anytime soon nor would most Russians pull out even if it ended. The war forced most of them to their own luck. Whenever I talk to Russians in Dubai, they tell me they love their life here much more than in Russia. They don't want to return because they have tasted life outside of Russia.

On another note, Russians haven't even been in the top 3 nationalities who buy real estate in Dubai. Those being Britains, Indians, and French (Britains being most consistent at the top).

2. Flippers artificially overinflating prices

The second scenario that might lead to a noticeable price drop (although I don't think it has enough power for an actual "crash", maybe up to 10% maximum of a price correction) is if flipping will be carried out to the extremes long enough.

Investors often make 30-60% profits within months by flipping off-plan properties (assuming they picked a good project that follows up with enough demand). The problem is that they do not add any value for the money they get, creating distress and imbalance in the market. They are somewhat the freeloaders in the market.

This may snap back at some point, but again, the scenario is not funded by any data or anything else tangible. It is merely an observation and a potential scenario that I can see playing out at some point from what I observe in the market.

Conclusion

I believe that the real estate market in Dubai is currently in a very healthy state.

I tried to infer a realistic crash scenario from the gathered data, but unless an unexpected major event causes people to flee the city, purely from a supply and demand perspective, I can not see the real estate market in Dubai pulling back whatsoever. Rising prices seem simply justified.

Most of the critical chatter is unfunded and not verifiable by any data. A certain group of investors bases their opinion solely on the price, assuming it is too expensive because of how they "feel" and want a better entry. In my opinion, this is an invalid approach and will only cause agony to investors hoping for better entries while prices will ruthlessly increase.