The Dubai real estate market has experienced phenomenal growth in recent years, and there is no sign of slowing down. With an influx of international investors, favorable market conditions, and a robust economy, the time is ripe to invest in Dubai's property market. This article will explore five compelling reasons why the Dubai real estate market will continue to thrive and offer lucrative investment opportunities.

1. Dubai is the new safe haven

Like Switzerland, Dubai has become a magnet for investors seeking to protect their wealth from inflation and taxation. The city's reputation as a safe and stable investment destination and favorable tax environment will continue attracting global investors.

Frankly, the government here just does many things right to attract capital and the working class from abroad. They have programs to encourage influencers and celebrities to promote Dubai, they are highly apolitical and integer to any conflicts outside, and they've successfully created a bubble of low crime, leisure, and superb service. The UAE is walking the slim line between extreme freedom and strict laws so masterfully that it dramatically improves people's lives.

This forward-thinking governance and the steady influx of capital will inevitably further fuel the growth of Dubai's real estate market. It is also why people choose Dubai as their escape plan whenever a crisis somewhere else in the world emerges, such as the case with Russia and Ukraine (which has brought countless investors here and undoubtedly played a critical role in the market growth).

2. Opening up to Chinese investors

Since the UAE lifted the travel ban for Chinese nationals in early 2023, the country has witnessed a surge in investment from China. Chinese investors are snapping up vast amounts of real estate (we have heard internal memos about cases where they have been driving around through the city, almost randomly purchasing entire buildings without leaving the car).

Investors from China have been buying up a lot of distressed companies and facilities in Europe and the USA during the pandemic, but it appears they have now laid an eye on the Middle East.

3. Room for growth compared to other major cities

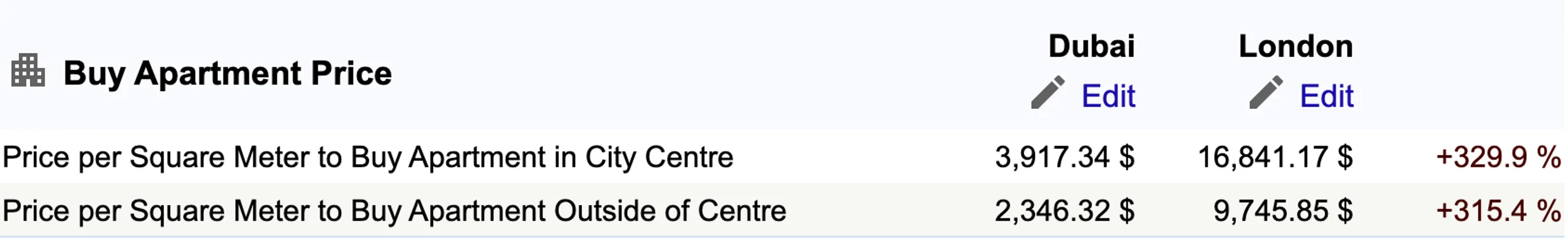

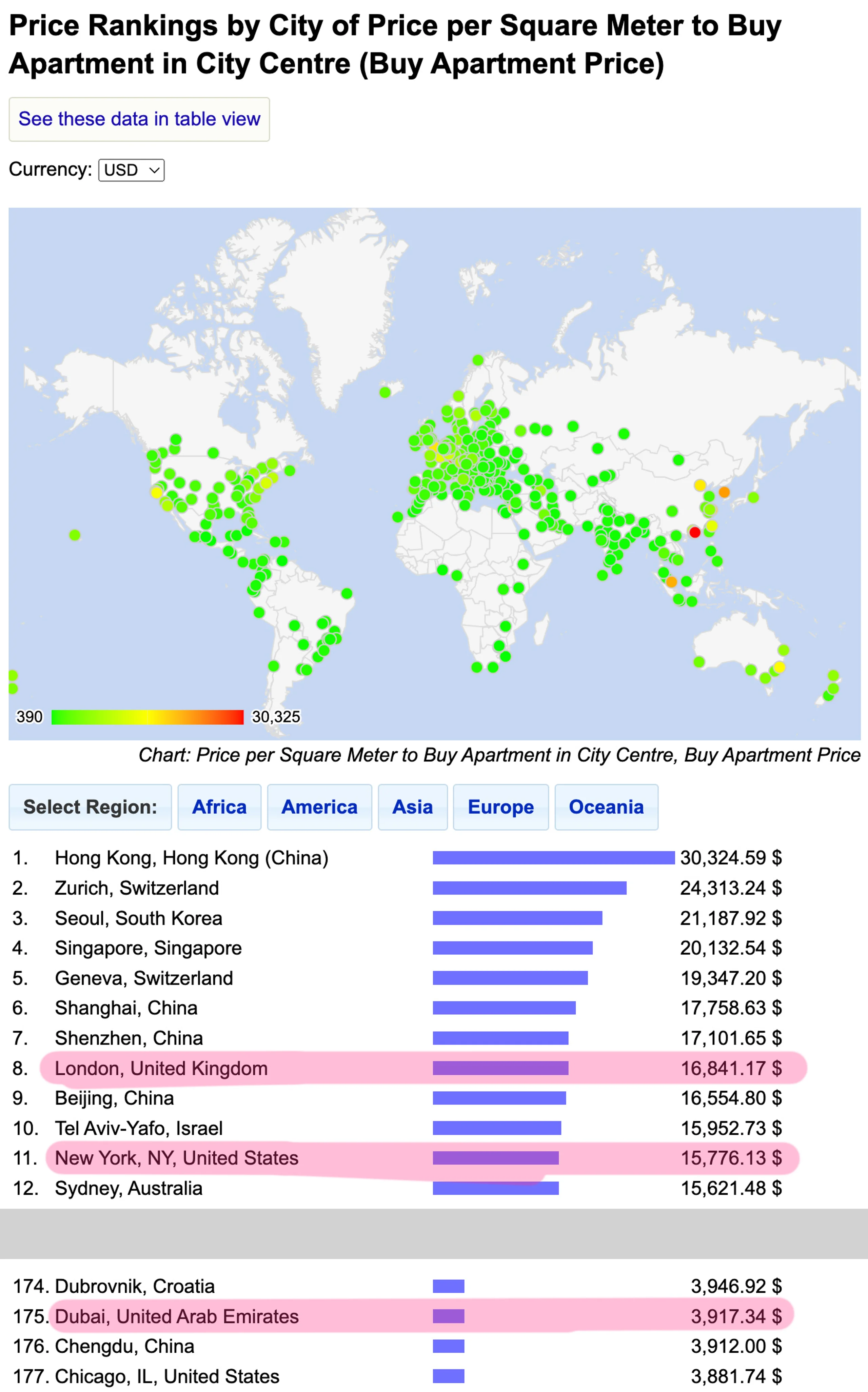

There is still significant room for growth when comparing Dubai's real estate market to other global cities like New York or London. For example, on average, you will pay $3,917.34 / square meter for an apartment in the city center of Dubai vs. $16,841.17 / square meter for the same in London (that makes London a whopping 429.9% more expensive, or a difference of 329.9%). Outside the center, you pay $2,346.32 in Dubai vs. $9,745.85 in London (415.4% more expensive, or a difference of 315.4%).

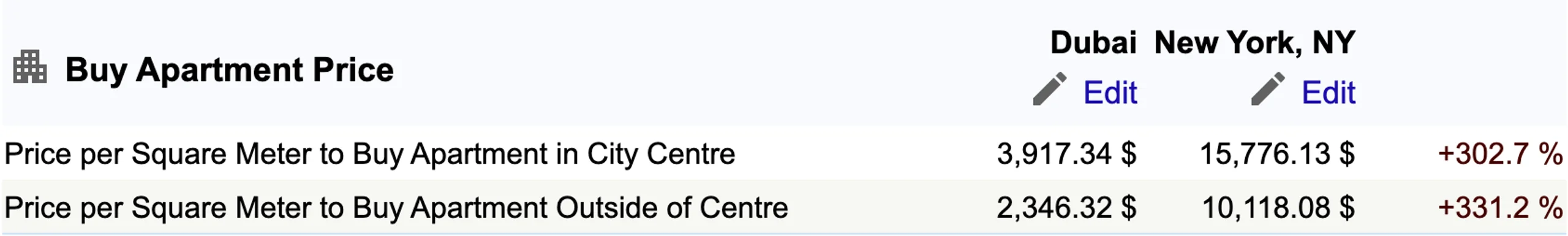

It's a similar story in New York:

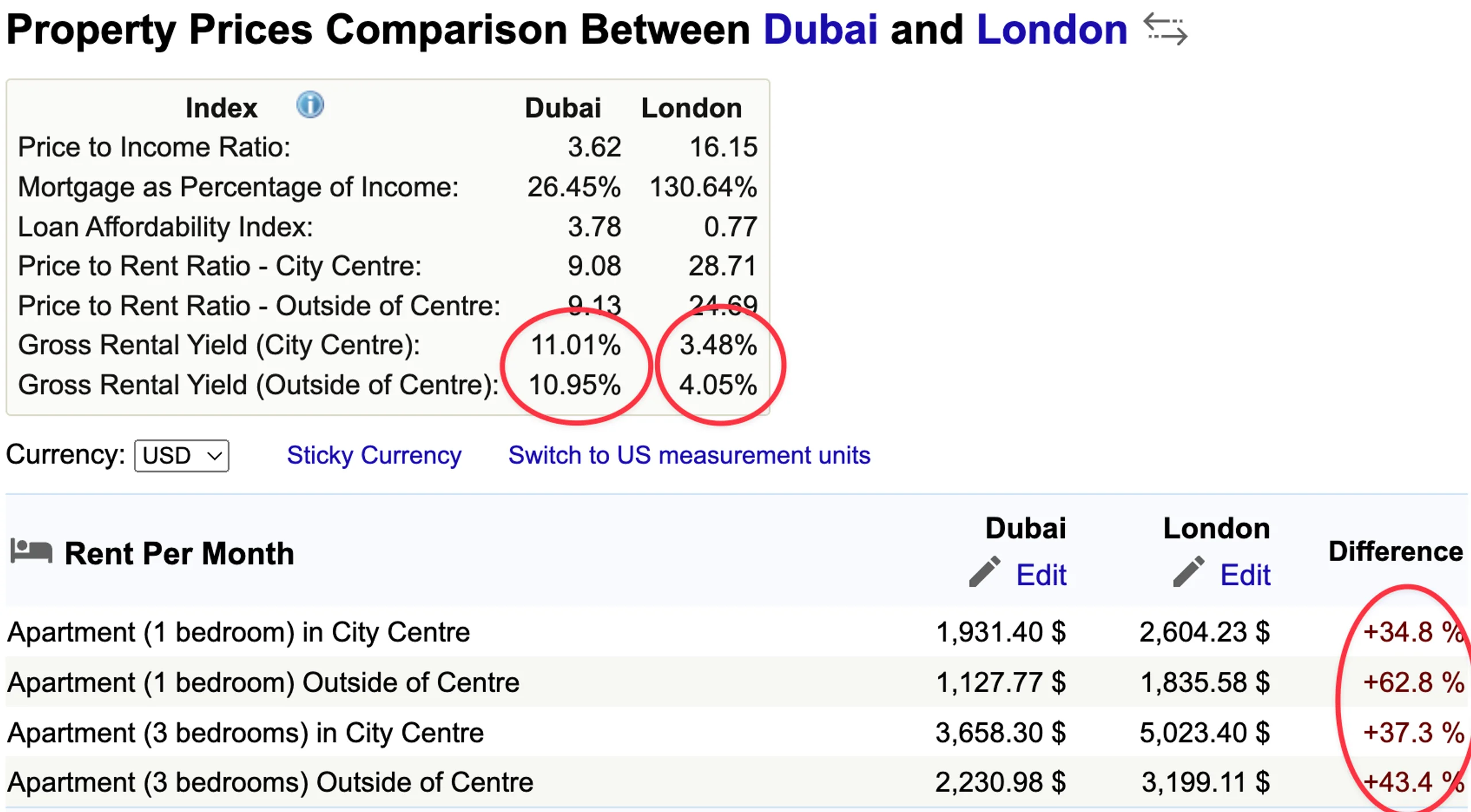

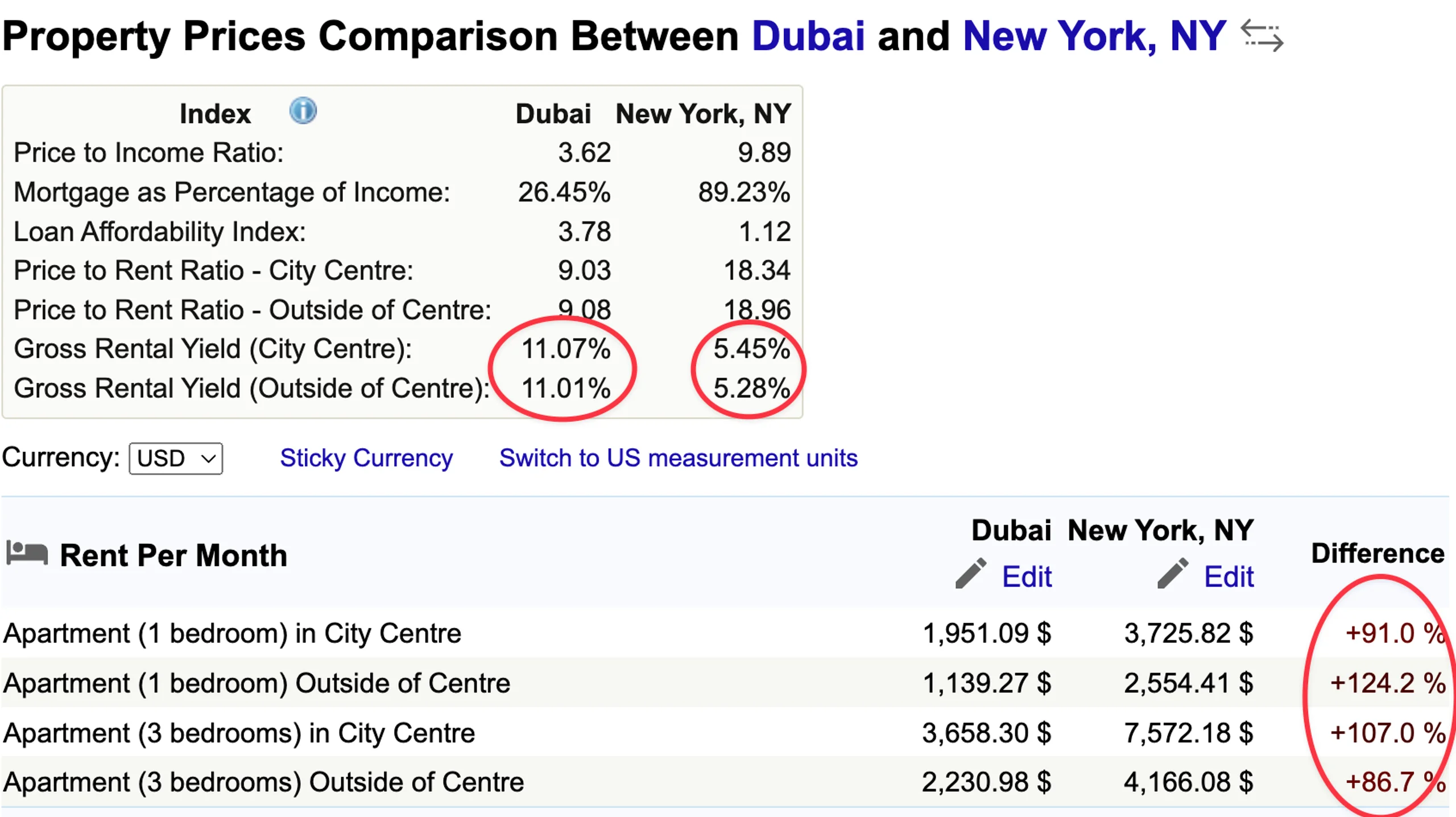

At the same time, rents are much closer in comparison, which opens up a massive gap and makes long-term renting in Dubai substantially more profitable.

So for London, rents for apartments are surprisingly cheap in the face of the outrageous buying prices. Rental yield is only 28-60.6% higher than in Dubai (don't forget the outrageously much higher buy-in price). Relatively speaking, this results in a 11.01% (Dubai) vs. 3.48% (London) average gross return of investment in city centers, respectively. Outside the city centers, you get a 10.95% yield in Dubai vs 4.05% in London.

In New York, rents for apartments are closer to sale prices. E.g., on average, you can rent for 86.7 to 124.2% more than in Dubai. But obviously, there is still a considerable relative imbalance in the price you have to pay to get in, making Dubai about a twice as profitable investment location than New York (~11% rental yield in Dubai vs 5% in New York).

Savvy investors worldwide have identified this gap and are now pushing relentlessly to take as much advantage as possible. With the prospect that Dubai offers, it is still one of the cheapest metropoles on earth to own real estate (place 175 of 421 tracked cities).

Find below links to sources, where you can look up the figures mentioned above (may deviate due to time passed since the article was published):

- Dubai vs London

- Dubai vs New York

- Global city ranking, sorted by price per square meter. The further down, the better for the investor (assuming you believe the city will do well in the future)

These numbers open up a gap that has yet to get filled. As people leave those western capitols due to high living costs and other factors, Dubai stands out as an attractive alternative. The migration of residents and capital to Dubai will continue to drive up demand for real estate and contribute to the market's ongoing expansion. There is undoubtedly much room to grow for Dubai.

If you don't believe it, bookmark this article for reference and revisit every few weeks. You will see how the gap keeps steadily closing, mainly by property prices in Dubai rising further.

Also, you will see Dubai creeping up the city ranking of price / square meter. At the time of writing this article, it was on place 175. What place is it at the time of you reading these lines?

4. Follow the smart money

Fifteen years ago, after I finished school, I went to the army. A peer went on to become a banker. During his apprenticeship, he found an ingenious way to make money on the side.

As we occasionally conversed, he told me he could see the stock purchases clients would make. And he exploited that by copying the biggest orders he could find. It went so well that he made around a thousand Euro per month just from investing the minimum wage salary he would get as a trainee. Not bad for a 20-years old!

Similarly, we now see whale investors scooping up real estate in the primary and secondary markets. For example, the CEO of Driven Properties (a large real estate broker) recently bought 40% of an Offplan project for more than AED 150 million (USD ~41 million). We have knowledge of several more investors like that, internally scooping up real estate in bulk, with their companies, and privately.

If you can believe that these people know what they are doing, or at least taking favorable, calculated risks, Dubai's real estate market is just getting started.

5. Market corrections vs. crashes

While it is true that no market can rise indefinitely, it is important to differentiate between a market correction and a crash. A correction, which may involve a temporary drop in prices, does not necessarily signal a crash where prices plummet by (subject to your personal definition of "crash") 30% or more. Based on current market trends and conditions, it appears extremely unlikely that Dubai's real estate market will experience anything close to a "crash" in the near future. As such, now is an ideal time to invest in this thriving market.

We human beings are emotional. And so, we have a severe tendency to overdramatize and overreact. A year ago, we were all afraid of a nuclear war that would destroy humanity. Four months ago, we thought the Euro would die. Today we believe the USA will collapse and the Dubai real estate market will "crash". We create imaginary scenarios in our minds driven by fear and hope, entirely neglecting what is happening in front of our eyes. And although there always is a chance these things could, in fact, happen, chances are usually slim.

6. Anticipating the unpredictable

Currently, the market in Dubai is soaring. It is doing so well that people believe it has to reverse soon. But markets usually don't do what people expect them to do at the time they expect them to do it. In fact, if you have any experience on the stock market, you will know that those who start betting against violent moves get burnt heavily more often than not.

Before any bigger market reverses significantly, it tends to behave more like a heavy container ship. It must slow down for some time, and only after will it change direction. This is even more true for the real estate market, where transactions and deals take significantly longer than on the stock market (where you just need to press two buttons on your phone).

Therefore, as we see this violent upwards surge, it seems unlikely that property prices in Dubai will go down anytime soon.

Conclusion

Dubai's real estate market offers a unique and lucrative investment opportunity for those willing to seize it. With the continued influx of Chinese investors, the city's emergence as a safe haven, and the potential for further growth compared to other global cities. Don't miss out on the chance to capitalize on this thriving market and secure your financial future.

I think there are no investors in the Dubai real estate market (or any other market, for a fact) who genuinely believe there will be a crash with no recovery. Most of the "crash prophets" are just bulls who hope to get better entry prices but have underperforming portfolios because they wait for the best price for too long. As the most successful investors know, it's not about timing the market but about time in the market.

Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.

Peter Lynch, famous author of "One Up on Wallstreet" and "Beating the Street". As manager of the Magellan Fund at Fidelity Investments between 1977 and 1990, Lynch averaged a 29.2% annual return.

With all emotions and hopes put aside, looking at the current situation, it seems more reasonable that the real estate market in Dubai will continue to soar and deliver outrageous profits to investors who are smart enough to invest quickly.